By Patricia Reynolds and Saumya Baunthiyal, Mastercard Multi-Rail Practice

Core banking systems today handle high volumes of transactions. Banks spend millions of dollars every year maintaining their systems to be resilient, fault-tolerant and immune to unplanned outages. Legacy core banking systems have traditionally succeeded in terms of reliability. Failures are rare, with some banks going without an outage for months, if not years.

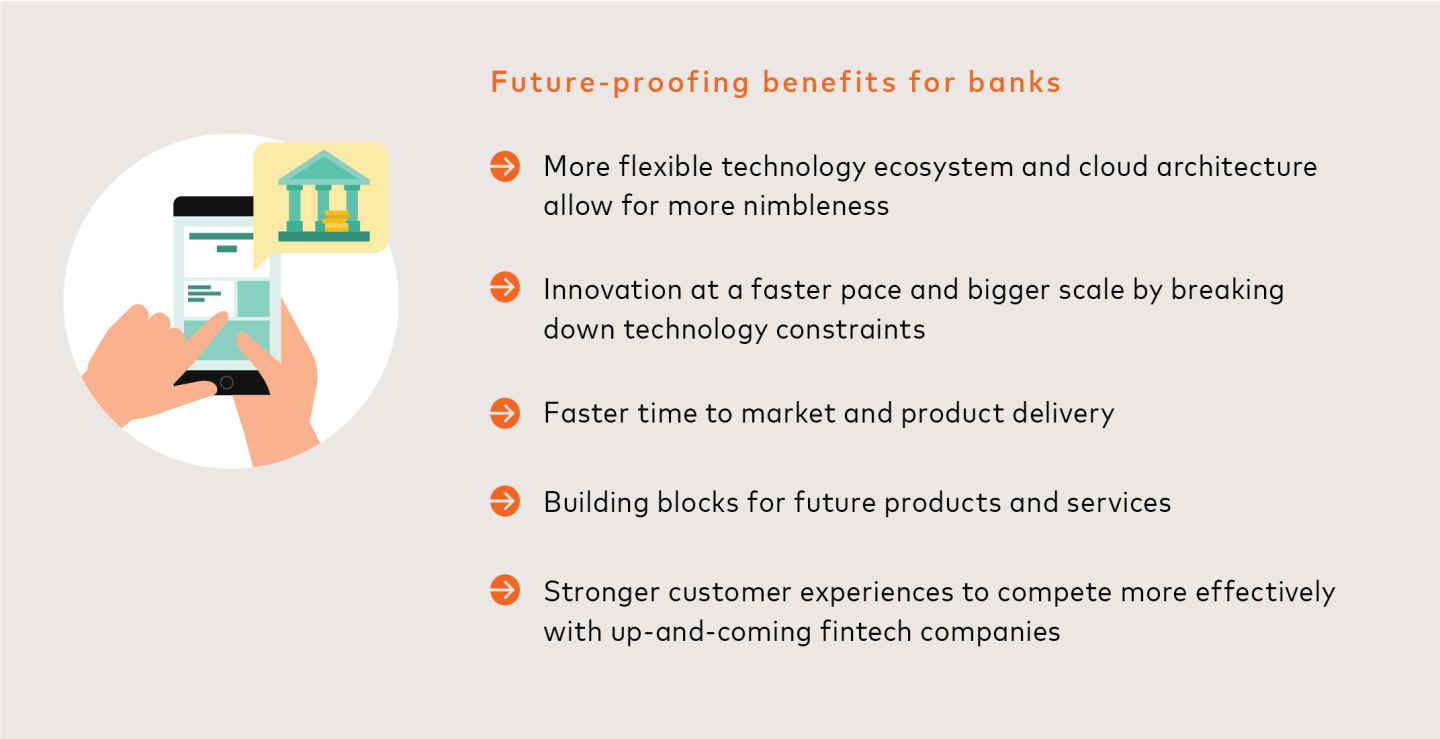

However, with the rise of digital banking, cloud services and open banking, innovative players have shifted how products are developed and partnerships are formed. The expectation of real-time transaction processing has become the norm and partnerships with financial technology (fintech) companies are more prevalent. Today’s innovators can release new payments products and related offerings more quickly while scaling their infrastructure needs to support the increasing demand for real-time payments (RTP).

Without investing in their infrastructures for these evolving changes, traditional banks risk losing customers to more nimble banks and banks that have formed partnerships with digital players. To compete with innovators and retain their customers, banks need to open their legacy systems to APIs and diversify their business models through several options depending on their brand strength, technological capabilities and financial resources. In this report, we address trends, challenges and solutions for financial institutions, including:

- Opportunities in real-time payments and open banking

- Preparing a banking infrastructure for the future of payments

- 5 steps for future-proofing a bank infrastructure

The RTP network saw an 8.7% increase in volume in 2021 as businesses and consumers switched to electronic payments. The payments ecosystem is evolving quickly, increasing the urgency for banks to upgrade their core systems. Read more by clicking the link below: